US Students Await Supreme Court Loan Decision

Last week, the Supreme Court began hearing arguments on President Biden’s student loan forgiveness plan, moving one step closer to a decision that will have wide-reaching consequences for both indebted students’ finances and the President’s discretion over federal spending.

In its questioning, the conservative-majority court seemed skeptical of the president’s authority to appropriate up to $400 billion without Congressional approval. The Biden administration, represented by Solicitor General Elizabeth Prelogar, said that a 2003 law called the HEROES act, which allows the Secretary of Education to provide financial relief in national emergencies, grants the administration the broad ability to cancel debt following the Coronavirus pandemic.

Before the court can decide the merits of these arguments, however, it will have to determine whether the plaintiffs have legal standing. In question are two separate cases—the first brought by two individuals and the second by a coalition of six states.

The individuals have argued that the Biden administration sidestepped the usual regulatory process which would have allowed them to provide their feedback, ultimately leaving them ineligible for some of the relief the current plan provides. The states hold that the plan would deprive them of tax revenue from payments made to in-state loan servicers.

Prelogar has rejected the assertion that any of the plaintiffs have standing. She said that the states have no official connection to the loan servicers who would lose out on payments for canceled loans and that the individuals have not been harmed solely by not benefiting from certain parts of the plan. “Parties cannot go to court to make themselves and everyone else worse off,” Prelogar said.

The plan offers up to $20,000 in forgiveness to those who have received Pell grants to help pay for their education and up to $10,000 for all others. The administration has stated that no high-income households or individuals, which they define as the top 5 percent of earners, will benefit.

The Department of Education projects that the plan will cost the government approximately $30 billion annually, for a total of $379 billion over ten years in today’s dollars.

The Brookings Institute, a centrist think tank in Washington, said that “in terms of its scale in budget and cost to taxpayers, widespread student loan forgiveness would rank among the largest transfer programs in American history.”

The plan has sparked heated debates in Washington.

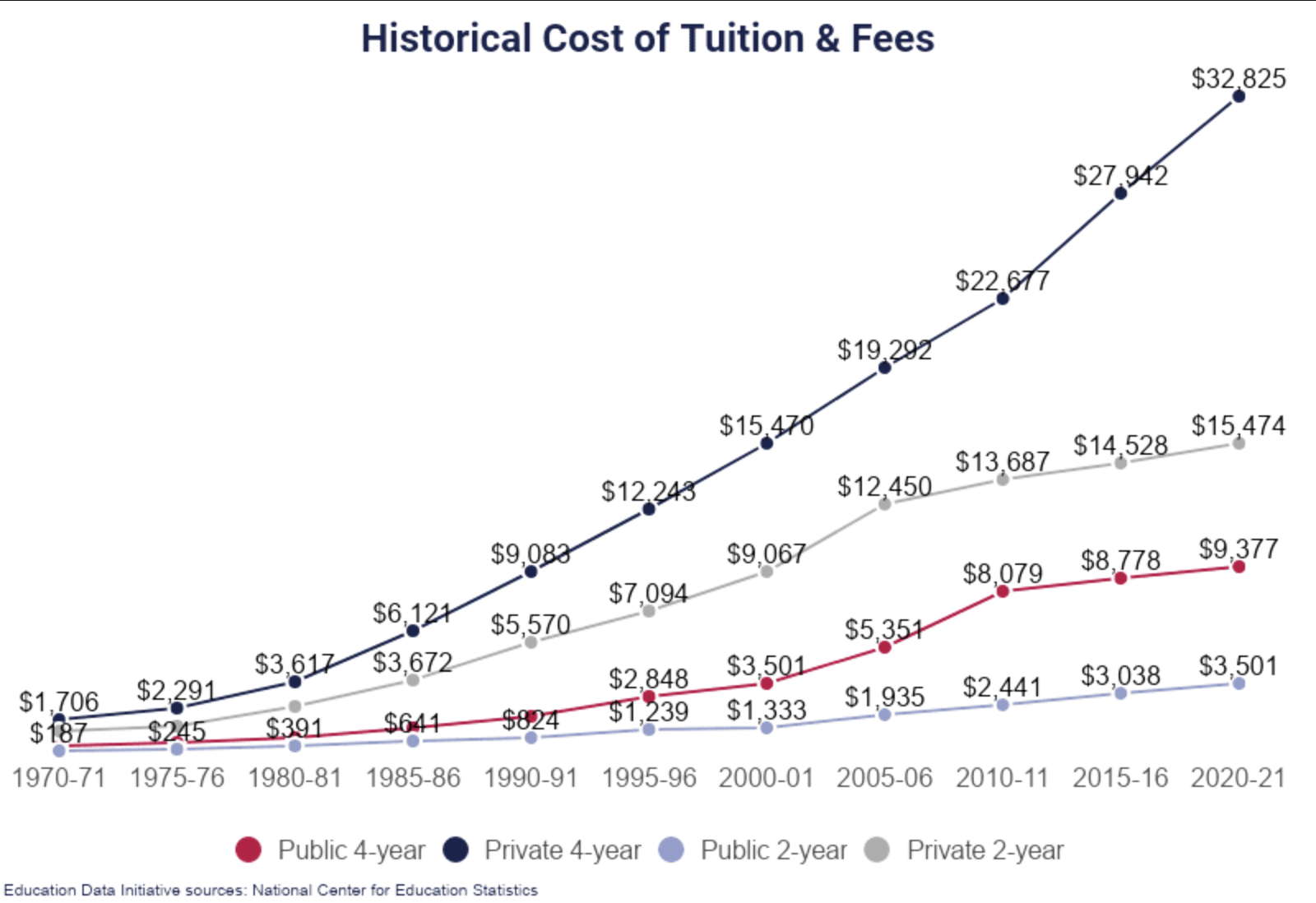

Proponents of the plan argue that it is necessary to counteract increases in the cost of higher education which have led individuals to take on record quantities of debt. The Center for American Progress, a liberal think tank in Washington D.C., said that student debt “meant to help individuals secure a brighter future has instead, too often, morphed into years of default and financial struggle for many borrowers and their households.”

Opponents argue that President Biden overstepped by implementing the program without congressional approval. The Cato Institute, a conservative think tank, said in a press release that “all evidence indicates that the government suddenly discovered the power to enact debt relief not because it is legally plausible but instead because it is politically desirable.” The institute, which receives significant funding from the Koch brothers, has filed amicus briefs supporting the plaintiffs.

Student loan forgiveness was a centerpiece of President Biden’s 2020 campaign. The administration announced the plan in August, but it was quickly blocked by the courts.

The court is expected to announce a decision by June.